do nonprofits pay taxes on lottery winnings

How do you pay taxes on lottery winnings. For tax year 2021the tax return you file in 2022you can add an extra 1700 to the standard deduction youre otherwise eligible for as.

Gifted Lottery Scratch Ticket From Mom Cashes For 1m Prize

If you play international lotteries from South Africa there may be tax laws in those countries that come into effect before you receive your winningsFor example the United.

. An average familys top federal tax rate could go from 22 percent to 37 percent. New York - 882 Maryland - 875 New Jersey - 800 Oregon - 800 Wisconsin - 765 Minnesota - 725 Arkansas -. You are not usually taxed on lottery winnings up to 5000 though anything over 599 will require you to fill out a special claim form to get your.

If this takes your estate over the IHT threshold 500k for a single homeowner or. Winning the lottery can affect your tax bracket in a big way. Here are the 10 states with the highest taxes on lottery winnings.

So even if you could direct your winnings into a trust fund to avoid paying taxes that 25 percent would be withheld. This is a special COVID. Regardless of the amount.

In Canada most lottery winnings are tax-free however the income generated from the winnings is taxable. The first rate is for people who earn 25000. But nonprofits still have to pay.

Any lottery winnings that you have accrued will form part of your estate once you pass away. Section 671b of the Tax Law and Section 11-1771b. Your recognition as a 501 c 3 organization exempts you from federal income tax.

According to CNN Money prize money is taxable income. Its a flat-rate whether you win a thousand dollars or a billion dollars. 31 2015 all prizes of.

Lottery winnings are taxed just like income and the IRS taxes the top income bracket. Youll have to pay Income Tax on your rent earnings if you make more than 12570 in overall earnings in one tax year whether its from rent your job or any other stream of. Paying Taxes on Lottery Winnings The IRS puts lottery winnings on the top income bracket with a 395 tax rate.

We never bill hourly unlike brick-and-mortar CPAs. See 72 PA CS. Enjoy flat rates with no-surprises.

But if you win a really big. The Michigan Lottery does not withhold any taxes on lottery prizes from 601 to 5000 but is required to report the winnings to the IRS and Michigan Department of Treasury. The IRS takes 25 percent of lottery winnings from the start.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Gambling and lottery winnings is a separate class of income under Pennsylvania personal income tax law. Do I have to pay taxes on 5000 lottery winningsIn the US if you win a lottery of 600 or less you dont have to report it.

These winnings are not taxed. Yes nonprofits must pay federal and state payroll taxes. Between July 21 1983 and Dec.

If you donate the winnings you could claim a charitable contribution deduction from your federal income taxes in the year of the gift of course. If you win more than 5000 you have to pay a 24 percent federal. The good news is that you dont have to pay taxes on lottery winnings at the highest tax rate.

There are two main tax rates for lottery winnings. The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members. But remember if that happens you likely wont.

Do senior citizens pay taxes lottery winnings. If you win in 2020 and give the winnings to a public charity you can claim a deduction for 100 of what is basically your adjusted gross income.

/cdn.vox-cdn.com/uploads/chorus_asset/file/5902101/shutterstock_254400031.0.jpg)

Lottery Winners Should Start A Private Foundation No Really Vox

What Is The Tax On Lotto Winnings In California

9 Ways To Spend Your Lottery Winnings Trust Will

Do Nonprofit Organizations Pay Property Taxes

New York Seizes 20 Million In Lottery Prizes From People On Public Assistance Newyorkupstate Com

How To Be An Anonymous Lottery Powerball Winner Stuart Law

6 Tax Financial Tips For The Next Lottery Millionaire Don T Mess With Taxes

Nonprofit Knowledge Sweepstakes And Other Prize Promotions Acc Docket

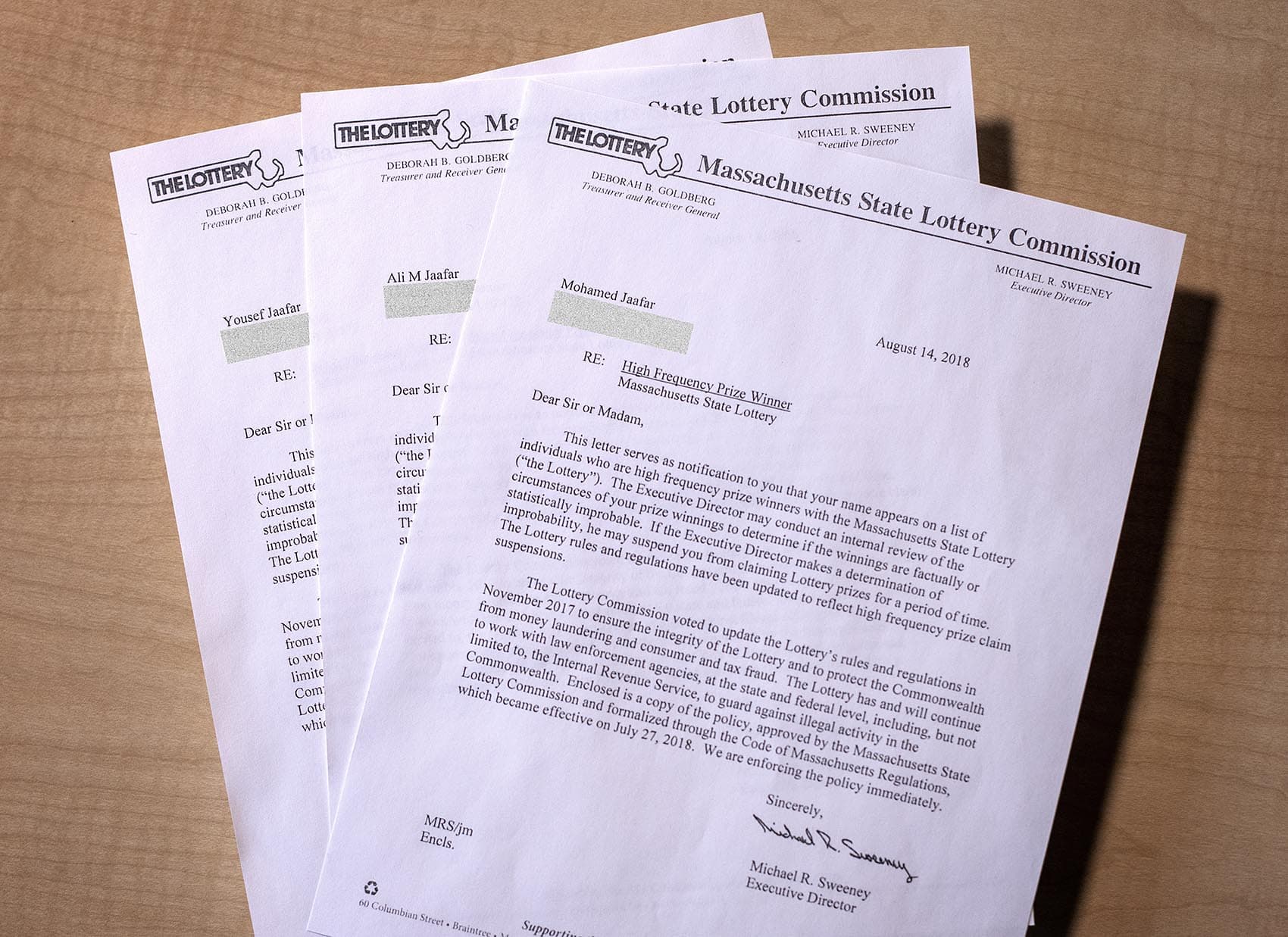

The State Lottery Has A New Rule To Stop Repeat Winners But So Far They Keep Winning Wbur News

How Much Do Lottery Winners Pay In Taxes 669 8m Jackpot Youtube

Where Do Lottery Profits Go States Use Them To Bolster Their Budgets Here Now

5 Nonprofit Fundraising Laws You Should Know About

How Does A Blind Trust Work For Lottery Winners

Despite Law Changes Lottery Winners Will Face Big Tax Bills

Informative Guide On How Lottery Winnings Are Taxed Ageras

The State Lottery Has A New Rule To Stop Repeat Winners But So Far They Keep Winning Wbur News

Is It Worth Paying For A 2 Mega Millions Ticket To Get A Shot At 810 Million It Depends Pennlive Com

If You Win Powerball In Oregon You Ll Get 92 Million Less Than If You Win In Washington Or California